The Middle-Market Effect

The term ‘middle market’ refers to businesses with annual revenues ranging from $10 million to $1 billion. In the economy and investments, mid-sized businesses and mid-sized investments often outperform the very large and the very small.

There are over 64,000 mid-sized companies in Australia with 20 – 199 employees as at June 2023[i]* Collectively these businesses employ over 3.1 million people, or 25% of the labour force, and contribute over $400 billion or 23% of Australia’s GDP.

The Australian Treasury reported some five years ago that many small-to mid-sized companies, particularly technology companies, find it difficult to scale up without government support. Large investment banks and private wealth firms tend to gravitate towards large ‘volume’ investments, overlooking the middle market and niche opportunities. However times are changing with some institutional investors now focusing on middle markets, having recognised better return opportunities despite higher effort to extract them.

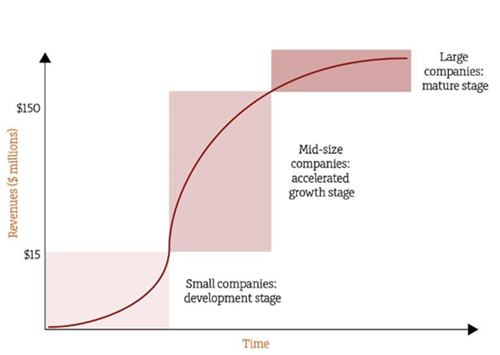

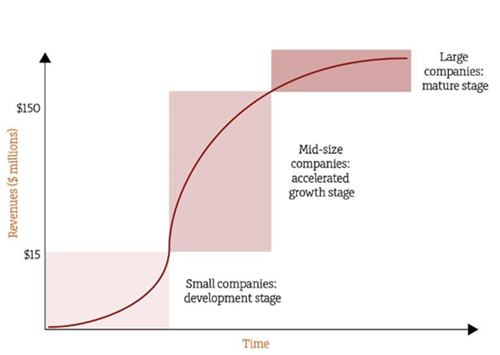

The Journal of Private Equity (Volume 2, no.3) observed that mid-sized companies are in the investment 'sweet spot' as they are less financially vulnerable than small companies and have greater growth potential than large companies. The size of companies highlighted was between USD $15 million and $150 million in revenue. They are also less dependent on debt to fund their operations and drive growth.

What industries and asset classes offer appealing middle-market investment opportunities?

-

Infrastructure

Middle market opportunities exist in infrastructure, with many leading infrastructure investment groups focusing on this following institutionalisation of many larger scale infrastructure assets such as toll roads, ports and airports. Governments are looking for solutions and private sector funding to construct new or refurbish old infrastructure. The largest proportion of funds raised are in funds less than USD 1 billion and returns are often higher according to a report from Stepstone and Preqin[ii].

There appears to be a return premium for mid-market infrastructure of around 2%, supported by lower entry purchase multiples than large cap peer industries according to a report by .[iii] A senior manager in this report observes that “If a manager can acquire a mid-market asset and grow it into a large-cap asset through strategic growth bolt-on acquisitions and active management, all else equal at the point of sale, it is likely to experience a valuation uplift”.

Some of the reasons for lower entry multiples is lower competition, as many large institutional investors and fund managers seek the large trophy assets, often bidding against other large firms to acquire them. The rationale for this ‘asset gathering’ behaviour is that it takes the same deal team to acquire a large asset as it does a mid-sized asset. Hence less willingness for larger fund managers to compete for mid-sized assets.

-

Real estate

We see similar behaviour in real estate in Australia with large super funds competing to buy large commercial real estate assets; and listed real estate investment companies building portfolios of mature, tenanted and large ‘core’ commercial buildings. Smaller wealthy investors can purchase commercial buildings directly at auction such as smaller supermarkets, petrol stations, quick service restaurants and high street retail shopping buildings valued between $10 - $20 million. According to JLL Australia the middle markets refers to property in the value range $25m to $150m[iv].

-

Private debt

In private debt the middle-market effect is observed in multiple markets, with research by highlighting better yields[v] and more favourable terms in middle market corporate lending[vi]. We see a similar pattern in real estate and asset-based lending.

The same principles as in mid-market private equity apply to corporate lending, that is the companies have grown to a level that allows them to accelerate beyond a very small company, and able to fuel that growth with lower levels of gearing that can also sustain higher interest costs than larger companies. There are better loan terms (known as covenants) available in middle-market lending to corporates, better access to reporting, management and simpler businesses than larger companies.

-

Agriculture

Agricultural assets benefit from scaling up from smaller family concerns to mid-sized corporatised operations. They gain efficiency from size but remain able to grow market share and operational efficiency further than larger agricultural operations.

In conclusion, the middle market effect is a premium of returns above smaller- and larger-sized investments that is persistent and accessible with select investment strategies and managers. Part of the reason for this is supply and demand, preferences of large investors, combined with growth opportunity that provides higher returns than the smallest- and largest-scale investments.

Seeking the middle-market effect across all asset classes can provide an additional premium above the broad average for an asset class, for example around 2% p.a. additional returns in private equity and infrastructure.

Macroeconomic Influences

Normal business cycles can affect the environment for private markets, including company earnings, inflation and interest rates for short- and long-term borrowings. Some periods particularly suit strategies in private markets that consolidate or break up businesses or use higher or lower borrowing leverage. Valuations on the majority of long-term investment assets are set relative to long-term interest rates such as the ten-year government bond yield. We see both secular trends and cyclical shifts in the economy influencing private markets. Interest rates have had the largest impact in the period since COVID-19, with government bond rates and cash rates rising from at, or near zero, to over 4 or 5% depending on the country.

Cyclical expectations for cash rate cuts are based on a slowing economy and inflation that has been trending down from peaks. Currently we don’t see interest rates returning to pre COVID-19 levels, and there are risks of future cycles seeing inflation and interest rates cyclically higher again. Most central banks have peaked or have commenced cutting rates however the US Federal Reserve has not cut yet and the RBA may hike cash rates one more time. Whichever party wins the US presidential election, will most likely keep government spending high with the potential to reignite inflation. Hence we are wary of risks to valuation from an uncertain environment.

In conclusion middle markets present an exciting opportunity for investors looking for longer term investments with excellent return potential. With opportunities to be found across many different asset classes, middle-markets have something to offer most preferences and risk appetites.

Partners Private focus predominantly on middle market investments when screening new opportunities for clients. To find out more or register to be informed of new opportunities visit partnersprivate.com.au

References:

[i] Small Business and Family Business Ombudsman.

[ii] https://www.stepstonegroup.com/wp-content/uploads/2024/01/Infrastructures-Middle-Market-An-emerging-opportunity-1-1.pdf

[iii] Patrizia: https://www.patrizia.ag/en/news-detail/harvesting-the-middle-the-alpha-in-mid-market-infrastructure/

[iv] https://www.jll.com.au/en/solutions/middle-markets-commercial-real-estate

[v] https://www.stepstonegroup.com/news-insights/a-systematic-approach-to-private-debt-allocation-in-institutional-portfolios/

[vi] https://www.stepstonegroup.com/news-insights/corporate-private-debt-primer/