What is Private Equity?

Historical foundations

Private Equity has been part of many institutional, family office and foundation portfolios for decades with the earliest investments undertaken by merchant banks and very wealthy families. As far back as the 1850’s merchant banks financed industrial and railroad businesses. Much of the family wealth that was built in private equity was then recycled into forming banking, private equity and development capital firms.

Corporate and government-sponsored venture capital funded some of the earliest scientific developments including the first integrated circuit . Decades later foundation and endowment funds commenced private equity programs as they had permanent pools of capital that could be deployed for higher returns while tolerating lower liquidity.

What is private equity?

Private Equity is the term used for investing in companies that are not publicly listed. Private Equity fund managers raise capital to buy into private companies, which they then manage and overhaul to earn a capital gain once the business is sold again at a later date.

According to the Institutional Limited Partners Association (IPLA) - an international association of private market investors - private equity is:

-

A source of capital for companies in need;

-

A key driver in innovation, economic growth and sustainability;

-

A job creator and supporter of thousands of companies (and the jobs they provide);

-

A source of wealth creation that supports retirements of most Australian superannuation fund members and in countries with pension systems such as the US which supports teachers, firefighters, police, other civil servants as well as helping to fund education, medical research, and the arts;

-

A reliable source of income for its investor;

-

A long-term investment with capital usually locked up for 10+ years;

-

Invested through a negotiated process with the majority of investments in unquoted companies;

-

Typically entails a transformational, valued-added, active strategy.

Why invest in private equity?

Private equity has grown steadily since the early 2000’s, producing strong average annual returns in the 20-year period ending June 30, 2020. There are many reasons why investors choose private equity investments some of which include:

-

Diversification to improve the risk/reward characteristics of a portfolio

-

Strong returns which compensate for illiquidity and market inefficiency

-

Active company management without the constraints of the public market

-

Private companies constitute a large portion of the overall market not addressed through other asset classes in an institutional portfolio

-

Private equity can drive better performance than public markets through alignment of incentives between managers and owners; active participation in strategy, management and operations; and less short-term pressure on performance.

Some of the key characteristics of private equity are explored in more detail below:

Return Characteristics:

Outsized investment returns have always come from the private markets first, with the further development of public stock markets allowing some growth companies to raise capital in competition or as an exit to private equity and venture capital. Today, the regulations for public share markets have become more onerous, particularly since the 2008 Global Financial Crisis, hence many private companies are staying private longer.

Public company management is driven by shorter term returns and pressure to grow earnings every quarter, largely due to visible stock prices, quarterly reporting and peer comparisons. This can mean that listed public companies can be less focused on longer term returns. Private companies can focus more on long-term growth and make investments that may not pay off for a few years, however the end result is a better overall return.

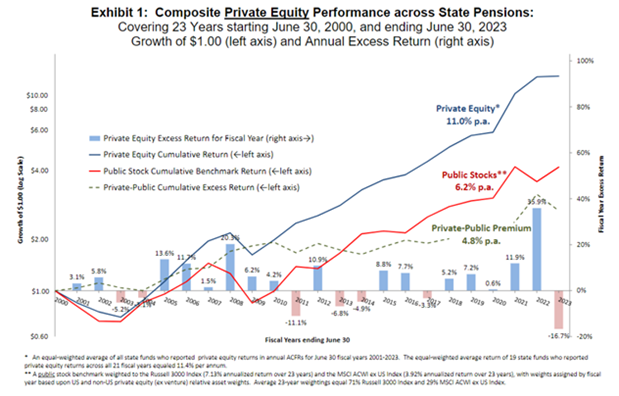

An industry study finds that private equity has produced a 4.8% annualised additional return over public equity. (CAIA Association, April 2024 “Long-Term Private Equity Performance: 2000 – 2023).

Investment Vehicles

In a similar trade-off between short and long-term returns, the choice to invest in private equity requires a willingness to tolerate poorer short-term outcomes for better long-term results. Publicly listed companies trade minute-by-minute, and the results of an investment decision can be seen in the price immediately, hence returns can come quickly or be taken away just as fast. Private market investments typically do not move in value due to conservative and infrequent valuation, and accounting codes with internationally recognised valuation approaches. Hence a need to wait for returns despite costs being incurred.

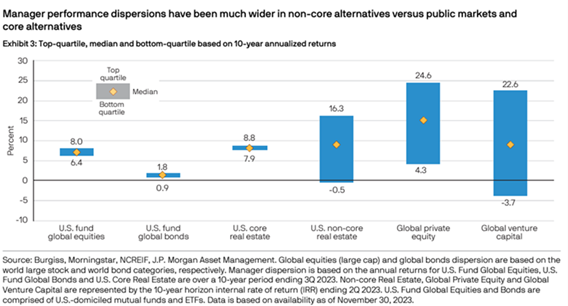

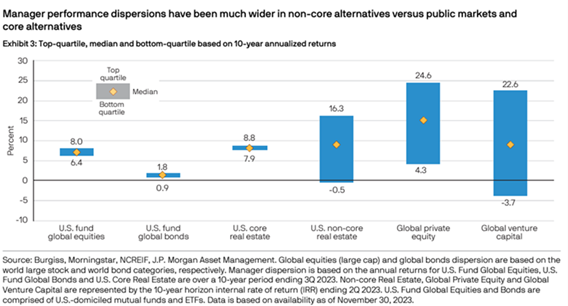

Dispersion of Returns and Selection

Dispersion of returns is high in private equity and venture capital compared to other asset classes as displayed in the graph below.

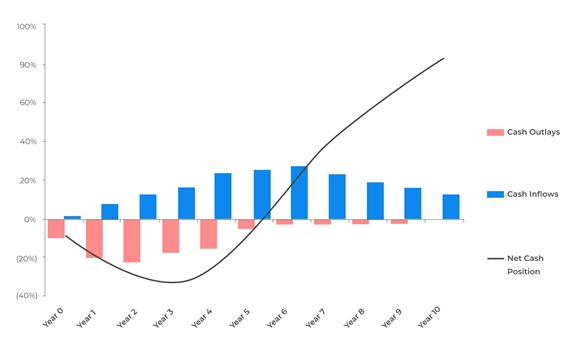

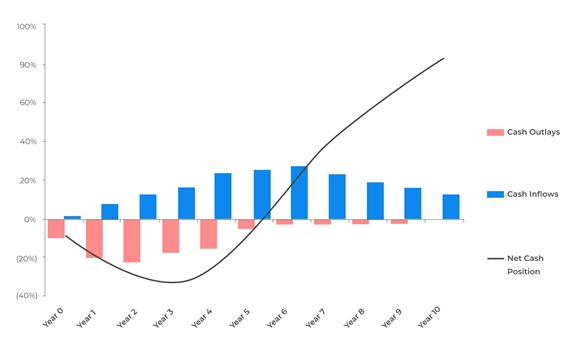

Investing in private equity requires patience

Investments in private equity have distributions that typically are not income but are returned as capital gains in later years. Therefore, early years can be valued at cost or conservatively until an exit takes place on individual companies. Once a few capital distributions of some original capital plus capital gains have occurred by mid-way to the latter half of the investment period, the net cash position returns to a positive level.

Despite not seeing a valuation uplift in the early years due to lack of revaluations and fees charged, some investors are despondent despite underlying companies growing revenues and profits quite well within the holdings of a private equity fund portfolio. It is important to communicate how companies are tracking to plan even though a final exit timing or price may not be known as each company investment is initiated.

Typically, the rewards are worth it in the long run given the average performance of private equity funds accumulates to be comfortably above public stock markets (4.8% according to the study above) and with less volatility.

The Corporate Finance Institute describe this impact of delayed returns, commonly known as the J-Curve as follows:

“In private equity, the J Curve represents the tendency of private equity funds to post negative returns in the initial years and then post increasing returns in later years when the investments mature. The negative returns at the onset of investments may result from investment costs, management fees, an investment portfolio that is yet to mature, and underperforming portfolios that are written off in their early days.”

This curve is represented graphically below:

This chart also highlights that an investor’s capital is not drawn all at once (ie ‘fully drawn'), however is invested in instalments over time, called by the manager after investments have been identified and committed to. This is called a ‘capital call’ structure where investors commit to an amount of investment in advance, and the private equity manager calls the capital in stages. In the early years the companies acquired usually have some debt facilities which is not unlike listed companies. The growth over time helps pay down debt and provide for further expansion and ‘bolt-on’ acquisitions.

The companies are then exited through IPOs, mergers and acquisitions to release capital and gains back to investors.

Developments in the private equity investor ecosystem has led to the development of other investment vehicles than the traditional 10-year lockup ‘primary fund’. There are ‘fund of funds’ which assist with accessing hard to get top performing funds. Secondary funds enable purchase of fund or company interests from existing investors, and co-investments allow investment in a single or small group of companies separate from a primary fund. We see benefits in particular fund of funds, secondaries and co-investments to address access issues and mitigate some of the ‘j-curve’ effect. There are now some open-ended funds with initial lockups of around 3-years, followed by quarterly liquidity. This is facilitated by shorter duration co-investments and secondaries entirely or alongside some primary funds. There may be cash or private debt that is at call or short maturity to facilitate redemptions besides the natural maturity of underlying company sale realisations.

In conclusion, the compelling reasons for investing in private equity are that there are higher returns than public markets due to a longer-term focus, alignment of management team’s ability to tailor financing and operational improvement more directly than a listed shareholder. The downside is that it does require patience and a deeper understanding of how these funds invest.